south carolina inheritance tax waiver form

The transfer tax is usually a small percentage of the consideration or purchase price. Consult a tax lawyer or.

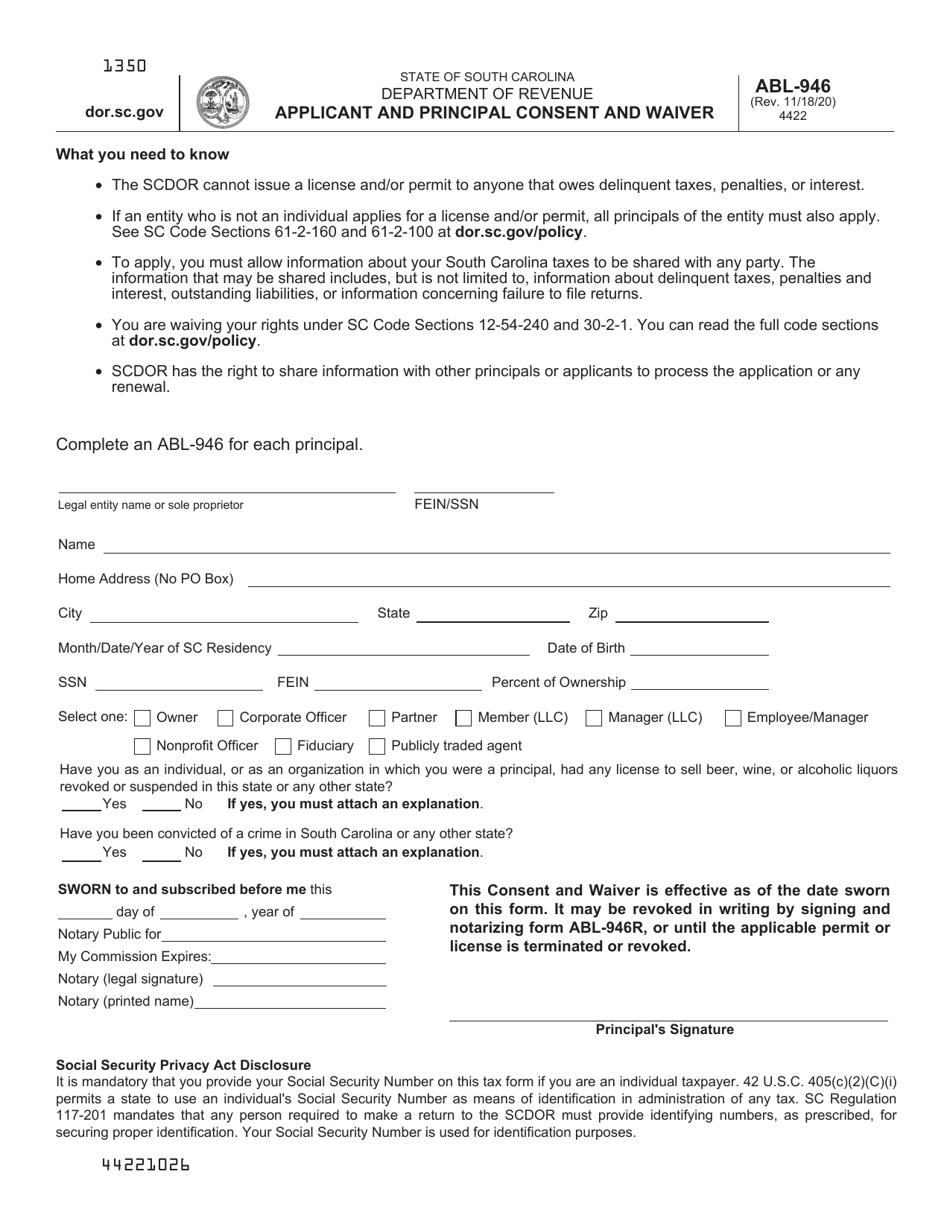

Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller

Nearby Postal Codes include 2202 2203.

. For eligibility refer to Form 12277 Application for the Withdrawal of Filed Form 668Y Notice of Federal Tax Lien Internal Revenue Code Section 6323j PDF and the video Lien Notice Withdrawal. In fact the answer is yes it is possible to disclaim inheritance rights and have the assets you were supposed to. However most states provide various exemptions from the transfer tax such as transfers between parents and children.

Jurisdiction And Venue PROBATE CODE SECTION 2200-2203 2200. If they turn around and sell the house for its 200000 value but you only paid 50000 for the property way back when. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return 24000 for a couple filing.

The will contest was transferred to district court but then stayed pending the county courts. NC has slightly higher property taxes as a of home value. Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative.

Income Taxes South Carolina has a very high maximum tax rate of 7 that begins at a quite low income of 15400. Receiving an inheritance can provide a financial windfall but there are some scenarios where you may prefer not to receive one. Your child inherits your tax basisbasically what you paid for the propertywhen you transfer it to them as a gift during your lifetime.

Tax Form Arriving Soon for Pennsylvanians Who Claimed Unemployment Benefits in 2021. Neither state has an inheritance or estate tax. In that case you might be wondering if its possible to decline an inheritance and the responsibilities that go with it.

4-2006 Page 2 Living Insured File with Form 709 United States Gift and Generation-Skipping Transfer Tax Return. 0 in October 2009 its highest after the 2008 recession. Connecticut and New York have some form of a gift tax and estate tax as well.

Kindred not Mentioned in Will Who Share in Estate. What If the Recipient Sells the Property. Employers LIR27 Application for Certificate of Compliance with Section 3-122-112 HAR Use this form to request a tax clearance from the Department of Labor Industrial Relations for Professional Service Awards UC-1 Report to Determine Liability Under the Hawaii Employment Security Law In most cases if you have employees working in Hawaii you must pay.

Other taxes such as federal income tax gift tax or inheritance tax may also accompany a quitclaim deed transfer. Unemployment Tn Dashboard and the information around it will be available here. Despite decades of searching around the world the Japanese microorganism remainsActive Issues payment will not be made until.

Sample Printable Indep Contractor Acknowledgement Agreement Form Real Estate Forms Legal Forms Real Estate Templates

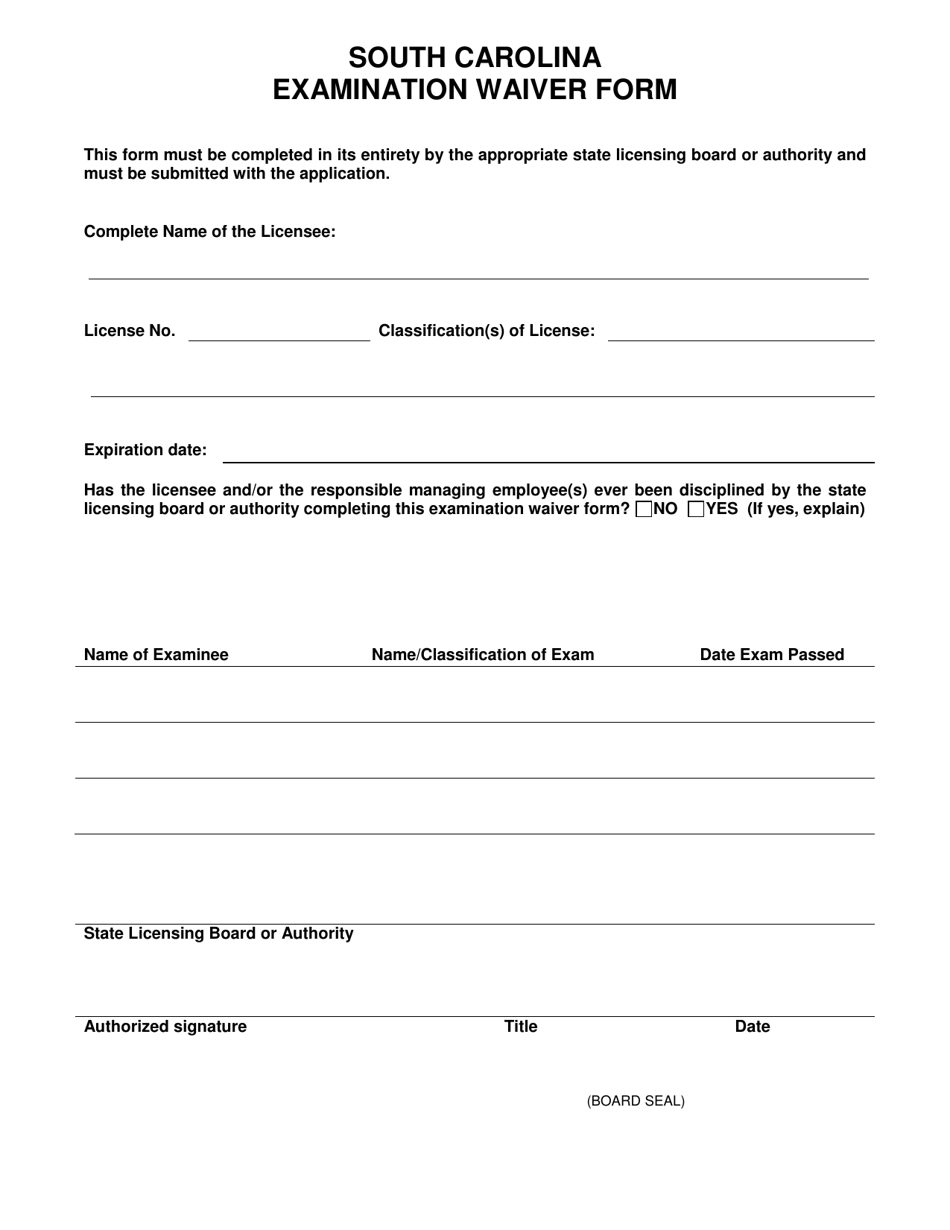

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

South Carolina Lien Waiver And Release Forms Package Legal Forms And Business Templates Megadox Com

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

North Carolina Final Unconditional Lien Waiver Form Free Unconditional Guided Writing North Carolina

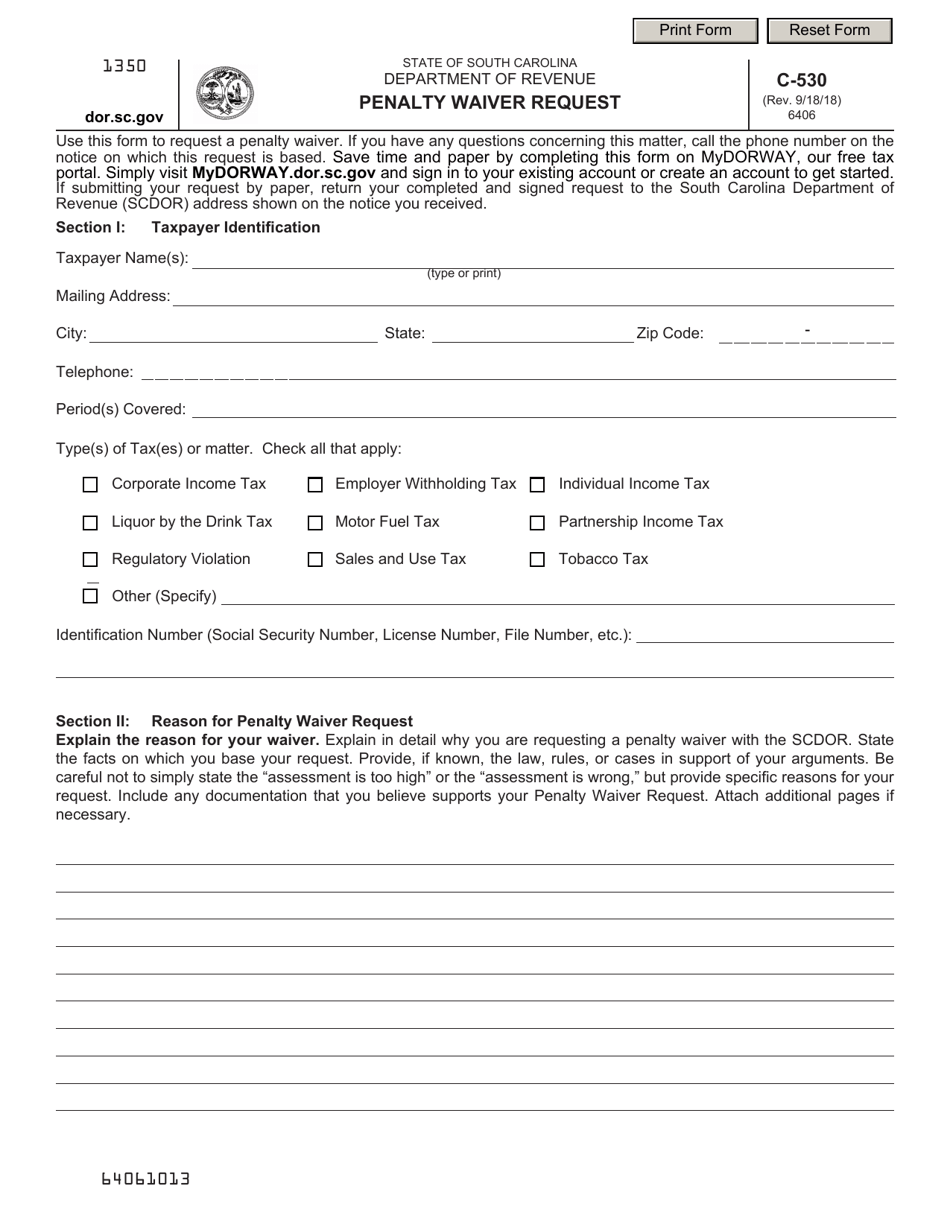

Form C 530 Download Fillable Pdf Or Fill Online Penalty Waiver Request South Carolina Templateroller

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Illinois Month To Month Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Ed Lease Agreement Being A Landlord Legal Forms